The insurer saw a minimal net gain after experiencing massive costs.

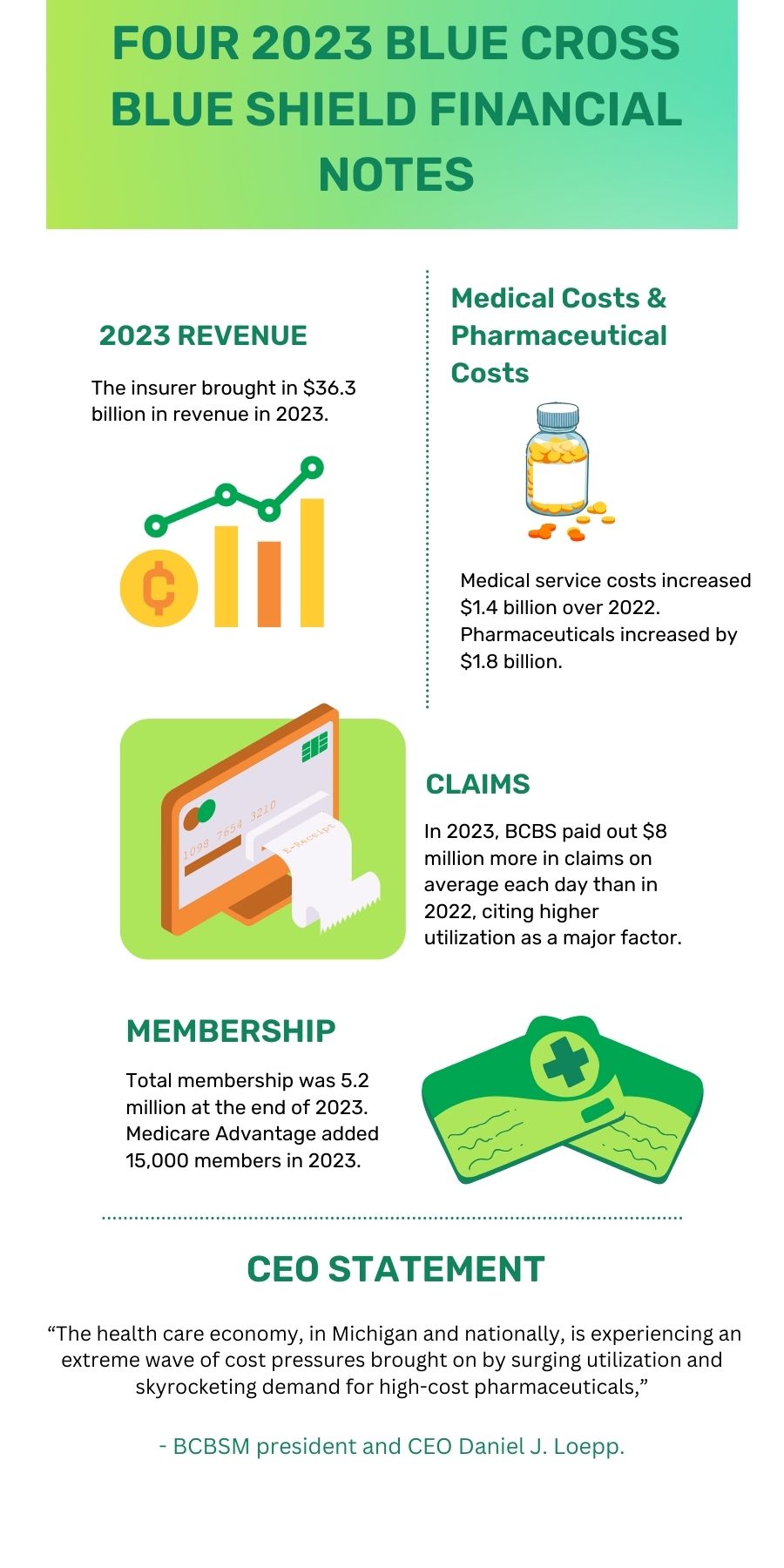

Earlier this month Blue Cross Blue Shield of Michigan reported a $3.2 billion increase in medical costs for 2023.

A new release showed the Detroit-based insurer had a net income of $100 million in 2023, which was 0.2% of the insurer’s total revenue. This was up from a $777 million loss in 2022.

Driven by increased medical costs, the company reported a $544 million underwriting loss, but it was later offset by earnings in investments and subsidiary profits.

In the news release BCBSM CEO stated: “The health care economy, in Michigan and nationally, is experiencing an extreme wave of cost pressures brought on by surging utilization and skyrocketing demand for high-cost pharmaceuticals,” said BCBSM president and CEO Daniel J. Loepp. “Despite these extraordinary pressures, Blue Cross retained our membership, managed a positive financial margin, and continued our dedicated efforts to promote affordable health coverage for our members in 2023.”

A handful of specific items affected BCBS’s finances in 2023. Other payers can note the uptick in pharmaceutical expenses and how Medicare Advantage kept BCBS’s total membership strong.

Check out the infographic below to see four items to note about BCBS’s 2023 finances.

Marie DeFreitas is the CFO editor for HealthLeaders.