Healthcare innovators need to be accounting for the volatile provider landscape.

Editor's note: This article was contributed by Neil Carpenter, a leader in healthcare innovation strategy, who has more than 20 years of experience facilitating strategic planning, GTM strategies and transformational change with boards of directors, CEOs, investors, and other senior stakeholders.

During the financial collapse of 2008 and the launching of the Affordable Care Act, members of the Obama administration use to say, “never let a good crisis go to waste.” With COVID-19, we might be doubling down on one crisis with another. The COVID-19 crisis appears to be sending health systems the wrong way on value, making a short-term crisis into a longer-term challenge.

Now, hospitals are trying desperately to cut costs to regain financial stability. That cost cutting includes the transition to other business models (such as value based care [VBC]). Which leads hospitals to do what they already do so well: see more patients. By doing just more of the same, they can increase revenue in order to cover rising labor expenses and their existing cost structure.

In this article, we will look at healthcare providers—particularly hospitals and health systems—to see exactly why innovators need to be accounting for the volatile provider landscape.

The battle for funding.

More than half of hospitals entered 2023 with negative margins and the financial situation for providers remained challenging for the first part of the year. According to Kaufman Hall, finances showed signs of stabilizing over the summer, but healthcare institutions have been financially struggling for years.

Normally providers have stable financial operations, disrupted only by a month because of a natural disaster or uptick in certain illnesses, causing a cancellation of elective surgeries. But recent long-term hits on the bottom line, coupled with the unpredictability of the post COVID environment, is a strange new world for everyone involved.

Health systems are not just pulling back with operating spending on innovation but their capital spending as well. We analyzed the top 20 provider-associated venture investment funds that are still on the market. Indeed, the total capital invested remains at 30-40% of pre-COVID levels; the same is true for the average deal size.

Enter value-based care.

The easiest solution for quick financial recovery is not VBC, even with all the great savings announcements out there.

One problem is scale, we see savings but without the context of total spending. As of the last year reported 2021, CMS boosts the program cut spending by $1.6 billion but that’s out of almost 1 trillion in total spending, or less than 0.2%. There’s also a lot of expert debate over what the real number is. Saving grew in later years but, as a Brookings institute clarified, “Did the MSSP save Medicare $1.2 billion in 2019? No—not even close. Might the true net savings be close to zero? Quite possibly.”

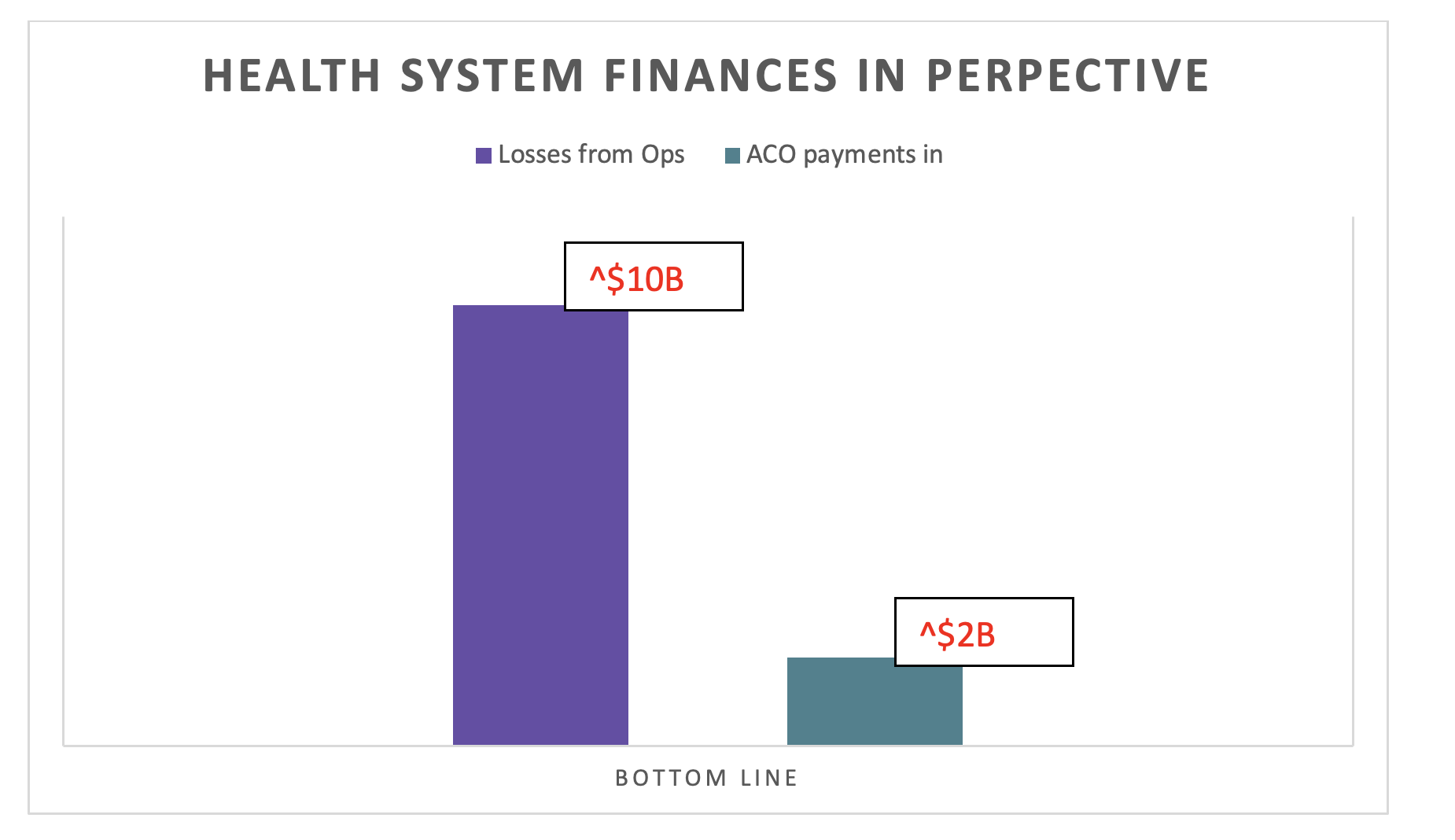

To put this into perspective, according to Statista, hospital losses in 2022 were about $10 Billion versus total hospital revenue of $1 Trillion and average operating losses of about 1%.

Losses vs. payments. Photo courtesy of Neil Carpenter.

Most of those savings went to physician groups not aligned with a health system. An article in NEJM explains, from the early ACO results, “After 3 years of the MSSP, participation in shared-savings contracts by physician groups was associated with savings for Medicare that grew over the study period, whereas hospital-integrated ACOs did not produce savings (on average) during the same period.”

Because health systems are anchored financially by hospitals, hospitals are largely fixed costs entities.

Health systems often, if not always, lose money on providers to act as a loss leader for fixed assets. For example, one analysis of a health system showed a 15% variable on manpower and materials costs of additional emergency department visitors. Inpatient beds were considered about 30% variable cost, at least in the short term, without opening and closing units.

Assuming the system does not have to build a bigger waiting room, open a new wing, etc., the hospital’s finances are best off when it is as busy as possible.

Inpatient vs emergency department cost variable example. Photo courtesy of Neil Carpenter.

The search for short term margin.

A few snippets of the convential wisdom that I have heard:

“When you come to sell something to a health system, you no longer say ‘this will save lives,’ because no one will buy it. Instead, you say, ‘this will cut your costs.’”

“Besides layoffs in operations, many health systems have cut their innovation and IT teams. While in some places it’s totally justified–e.g., innovation teams are often reactive, and do not actually implement new projects–this will slow the innovation down even more.”

“The search for value is down–it's back to basic operations such as driving cost and volume.”

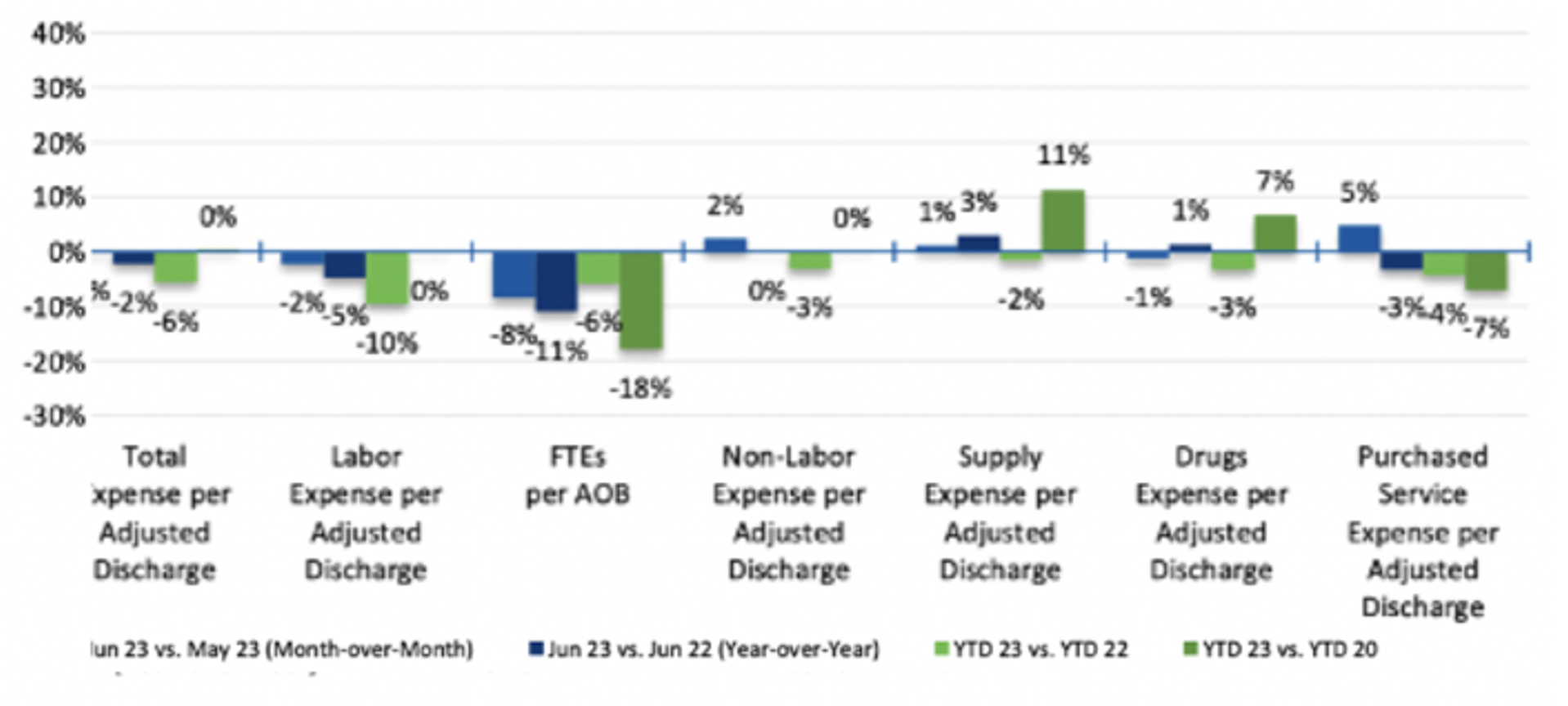

This rhetoric translates into action in this expense report from Kaufman Hall:

Photo courtesy of Kaufman Hall.

A prevailing cost saving trend involves the strategic transition of operational functions to external vendors, coupled with the substitution of human personnel for advanced software systems.

The robotic process automation revenue cycle companies have struggled, most notably Olive, which raised almost a billion dollars in capital but recently shut down. As one former executive from the company said, “[the tech] just isn’t working the way we thought it would”.

There is excitement, however, about other less complex technology plays, including a “digital assistant” that automats countless administrative workflows while performing millions of tasks every week and a platform that provides customized workflows to healthcare teams in order to collaborate on administrative tasks using bi-directional connectivity.

Another cost cutting strategy? Volume, volume, volume.

The cleanest, lowest cost answer to financial difficulties, is to get paid more for doing exactly the same thing. But even big commercial rate increases cannot plug the financial holes of systems that are mostly Medicare and Medicaid driven. Those payers have no plans of radically increasing their rates.

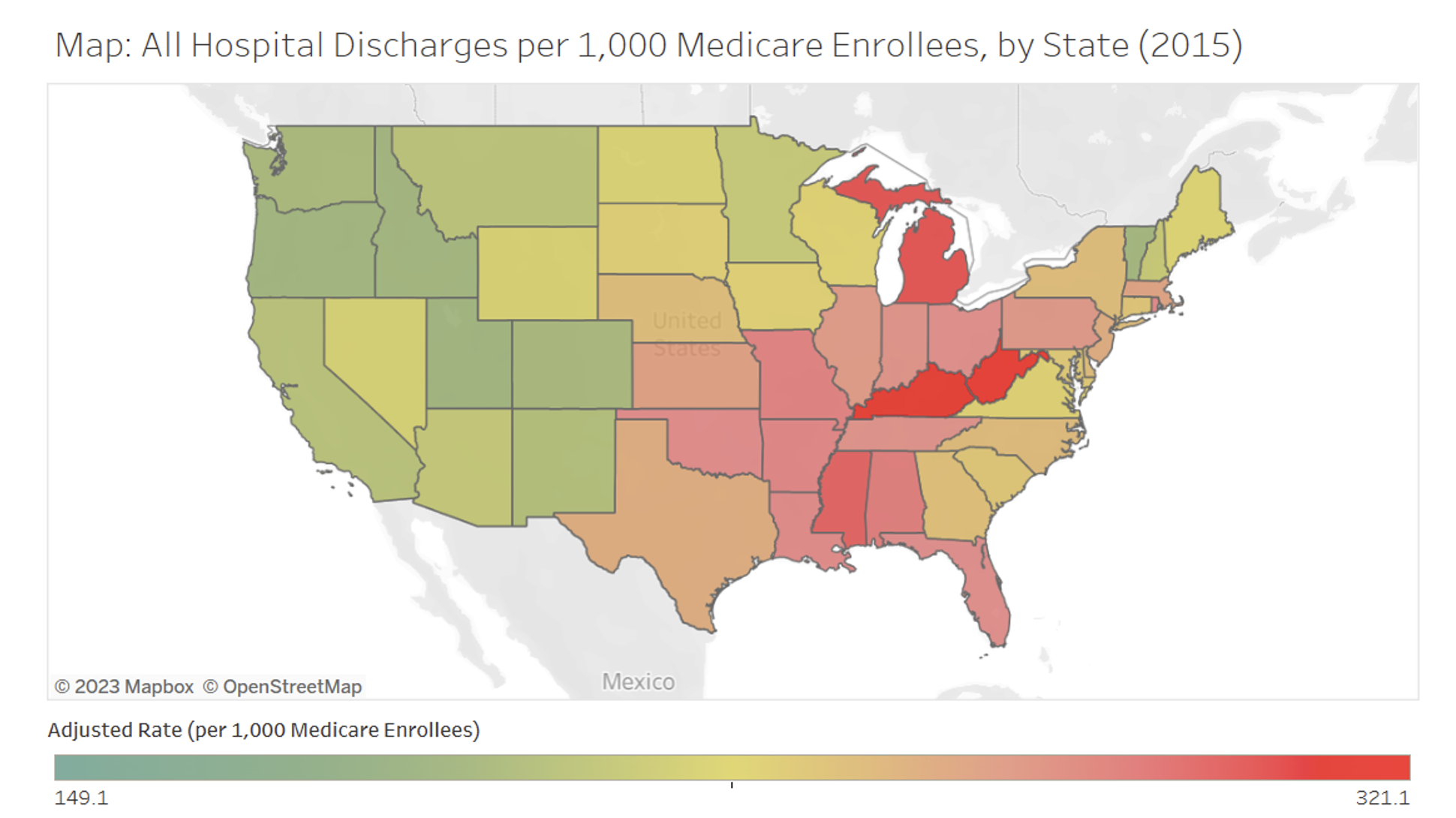

As one testing of the volume hypothesis, let us look at utilization across the country and compare one region that tends to have a lot of inpatient admissions of its Medicare members versus another where there is less.

Let’s take California and Florida. California is typically a strong managed care state while South is considered the wild wild west. As one ED doctor in south Florida said, “If you can’t admit enough patients, they will find someone who can.”

In California, the Medicare inpatient utilization rate was 212.80 per 1,000 Medicare enrollees. In Florida the rate is 277.60, or about 30% higher.

Source: Medical Discharges – Dartmouth Atlas of Health Care

Since there were about 5.8 million patients on Medicare in 2016 in California, if their utilization matched Florida’s, there would be around 377,00 more discharges in the state (total population use rate differential).

Healthcare Utilization Project reports from more recent Medicare data, shows a similar differential.

Given the average revenue associated with a Medicare discharge is about $14K, that represents about $5 billion in new revenue for just California hospitals, according to the Healthcare Utilization Project.

Given the previous discussion of 30% variable costs, that means that $5 billion in new revenue would translate to over $3 billion in incremental healthcare system margins, or more than the total ACO payments across the entire country to all hospitals. And that’s all margin, obviously the ACOs spends money to make money.

Another way to look at it: who is doing well? It’s the for-profit hospitals that are crystal clear about their mission and laser-focused on high-margin procedural volume in and out of hospitals.

Implications.

We need to realize that providers have a range of business models and need to be realistic about what we expect from providers with large fixed costs who are under fiscal constraints. More radical experimentation models like Maryland’s deal with CMMI where the hospitals and providers are largely capitated is the kind of model that could be a viable transition in times like these.

And VBC means less capacity at some point. We need to think about how to change capacity over time without losing access to vital services.

Payers and providers with limited fixed assets whether its emergency rooms or ORs will need lead the way on value for now.

Author's note: Both Natalie Dranchuk and Shafrin Mustafa, MBA, contributed to the research of this article.

Editor's note: Care to share your view? HealthLeaders accepts original thought leadership articles from healthcare industry leaders in active executive roles at payer and provider organizations. These may include case studies, research, and guest editorials. We neither accept payment nor offer compensation for contributed content. Send questions and submissions to Erika Randall, content manager, erandall@healthleadersmedia.com.

Neil Carpenter, a leader in healthcare innovation strategy, has more than 20 years of experience facilitating strategic planning, GTM strategies and transformational change with Boards of Directors, CEOs, investors, and other senior stakeholders.

KEY TAKEAWAYS

COVID-19 sent health systems the wrong way on value, making a short-term crisis into a longer-term challenge.

Now, they are trying desperately to cut costs to regain and maintain financial stability.

Healthcare innovators need to fully understand, and be accounting for, this volatile provider landscape in order to succeed.